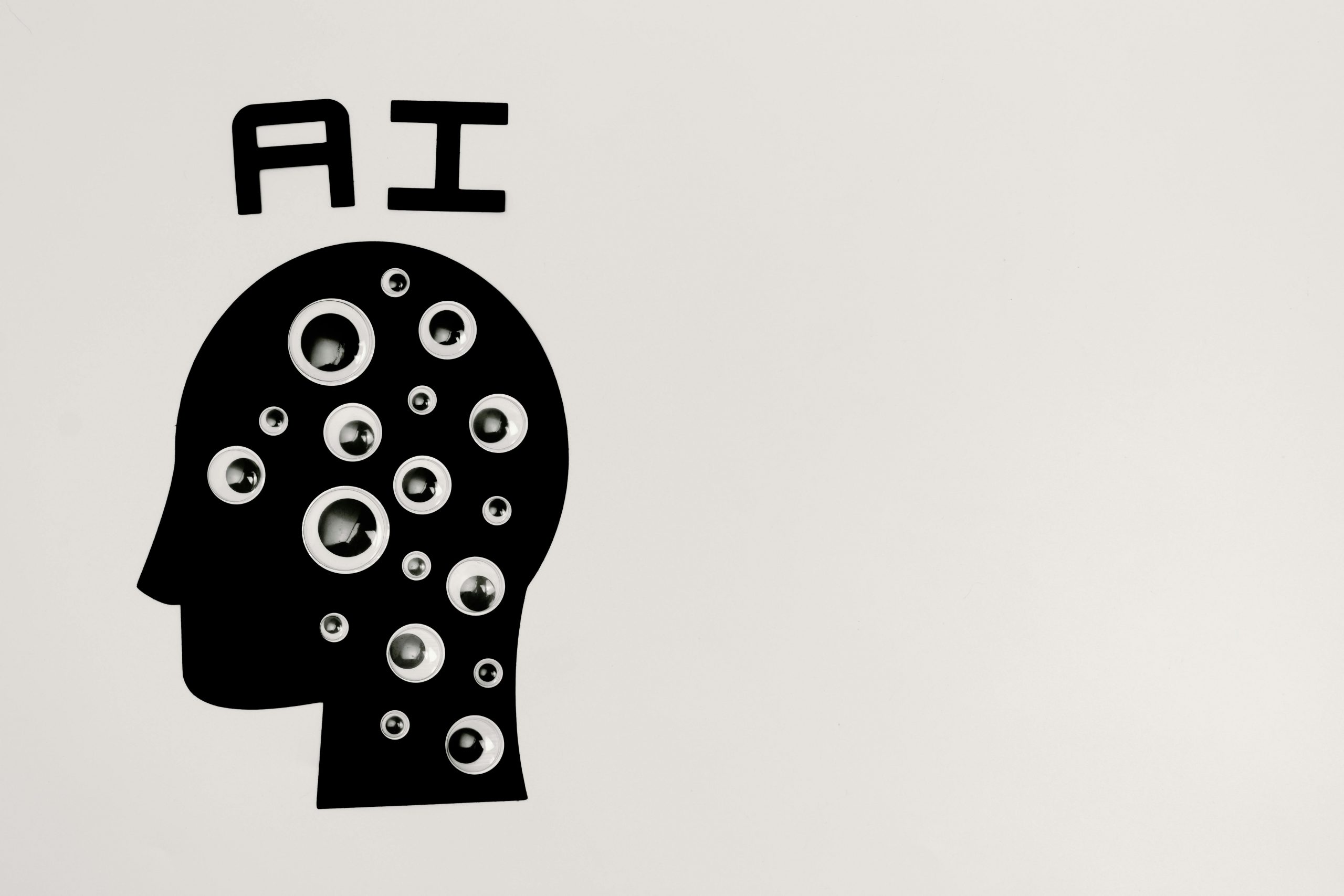

AI in Mortgage Lending: Will It Replace Loan Officers?

In the age of rapid technological advancements, the rise of AI in mortgage lending is revolutionizing workflows, automating repetitive tasks, and providing predictive analytics., automating tasks, and providing predictive analytics. From automating repetitive tasks to providing predictive analytics, AI is becoming a powerful tool for mortgage professionals. But with its increasing presence, a critical question emerges: Will AI eventually replace loan officers?

The Role of AI in the Mortgage Industry

The rise of AI is reshaping the job market across various sectors. According to the World Economic Forum, AI is expected to impact jobs globally, creating new roles while automating others. In the mortgage industry, AI is already making significant strides, with platforms like True AI transforming the loan processing workflow by automating repetitive tasks and enhancing communication between loan officers and borrowers (True AI).

AI is already making significant strides in the mortgage industry. Systems like automated underwriting software, chatbots, and CRM tools powered by AI are streamlining processes that once required extensive manual effort. These technologies can:

- Automate data collection and document verification

- Provide instant loan pre-approvals

- Analyze borrower creditworthiness

- Send personalized follow-up emails and SMS

For example, platforms like Blend and Ellie Mae leverage AI to expedite the mortgage application process, reducing loan processing times and increasing accuracy. But while AI can handle data processing and administrative tasks, it lacks one key element—human connection.

Why Loan Officers Are Still Essential

Despite the rise of AI, loan officers bring a personal touch that AI can’t replicate. Mortgage lending is more than just numbers and data; it’s about understanding clients’ unique financial situations and providing tailored advice.

Here’s why loan officers remain irreplaceable:

- Emotional Intelligence: Loan officers can empathize with clients, building trust and offering reassurance during stressful financial decisions.

- Complex Problem Solving: While AI can analyze data, it can’t interpret nuanced borrower scenarios that require human insight and judgment.

- Relationship Building: Many borrowers prefer to work with someone they can trust, especially when navigating the complexities of a mortgage.

AI in Mortgage Lending: A Tool, Not a Threat

While AI is automating many aspects of the mortgage process, it doesn’t mean that loan officers are becoming obsolete. According to a report by Homebot, AI-powered tools are being designed to complement, not replace, loan officers. By handling administrative tasks and data analysis, these tools free up time for loan officers to focus on complex problem-solving and client interactions. Additionally, platforms like True AI are providing advanced AI assistance to streamline workflows without compromising the personal touch loan officers bring to the table (True AI).

Rather than replacing loan officers, AI can be seen as a tool to enhance their capabilities. By automating repetitive tasks, AI allows loan officers to focus on building stronger client relationships and closing more deals.

For instance, AI-driven CRMs like Mloflo can:

- Track borrower interactions and send timely follow-ups

- Automate marketing campaigns to nurture leads

- Analyze borrower data to identify opportunities for refinancing

This synergy between AI and loan officers creates a more efficient workflow, allowing LOs to work smarter—not harder.

The Future of AI in Mortgage Lending and Loan Officers

Looking ahead, the mortgage industry will continue to integrate AI into its processes. A study by ICE Mortgage Technology reveals that borrowers expect faster, more efficient service, making AI-driven CRMs like Mloflo a valuable asset. However, the Bureau of Labor Statistics projects steady job growth for loan officers, emphasizing that the human element remains vital in guiding clients through complex financial decisions. Thus, AI is not a replacement but a strategic tool that allows loan officers to work more efficiently and effectively.

The mortgage industry is evolving, and AI will continue to play a significant role in streamlining processes and improving efficiency. However, the role of the loan officer is far from obsolete. In fact, as AI handles more administrative tasks, loan officers will have more time to focus on strategic relationship-building and providing personalized service.

Ultimately, the key to staying relevant in a tech-driven industry is to leverage AI as a complementary tool rather than a replacement. By combining AI’s analytical power with a loan officer’s human touch, mortgage professionals can deliver a seamless, client-focused experience that no algorithm can replicate.

Additional Resources and Sources

For more insights on how AI is impacting loan officers and the broader mortgage industry, explore these resources:

- World Economic Forum: How AI is Changing Jobs

- University of San Diego: The Impact of AI on the Job Market

- Homebot: Top AI Tools for Loan Officers and Realtors

- Good Vibe Squad: Will Loan Officers Be Automated?

- Bureau of Labor Statistics: Loan Officer Job Outlook

- ICE Mortgage Technology: Borrower Insights Data

- True AI: AI in Mortgage Processing

- True AI: AI Assistance for Loan Officers

Final Thoughts

AI is transforming the mortgage landscape, but it’s not here to eliminate loan officers—it’s here to elevate them. By embracing AI as a strategic partner, loan officers can enhance their productivity, deepen client relationships, and position themselves as indispensable advisors in an increasingly digital world.