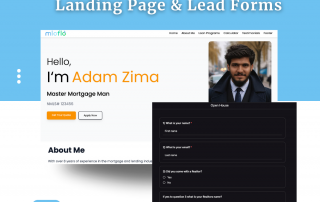

Initial Mortgage Meeting

Initial Mortgage Meeting: Setting the Stage for a Smooth Mortgage Process Your initial mortgage meeting with a borrower is more than just a conversation—it's a strategic moment to lay the foundation for the entire mortgage process. When handled intentionally, this ... Read more