How to Optimize More Deals Using Lead Forms

In the fast-paced world of mortgage lending, speed and efficiency are key to closing more deals. One of the best ways to streamline your process and maximize conversions is by utilizing lead forms. They not only help capture valuable information but also ensure you’re following up with the right prospects at the right time.

In this post, we’ll dive into how loan officers can make the most of lead forms to optimize their deals and how Mloflo’s new lead form feature can take your process to the next level.

Why Lead Forms Are Essential for Loan Officers

Lead forms allow you to capture essential data from potential clients, including their contact information, loan preferences, and needs. By collecting this information early, you can:

-

Segment your leads effectively for personalized follow-ups.

-

Speed up your response time, showing prospects that you’re on top of their needs.

-

Track engagement and adjust your strategy based on the quality and volume of leads.

The faster you can follow up with prospects and tailor your communications, the higher your chances of turning them into loyal clients.

How Mloflo’s New Lead Form Feature Works

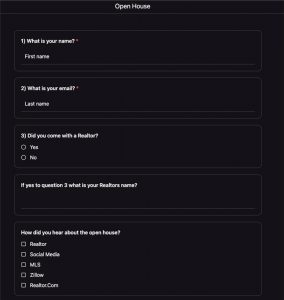

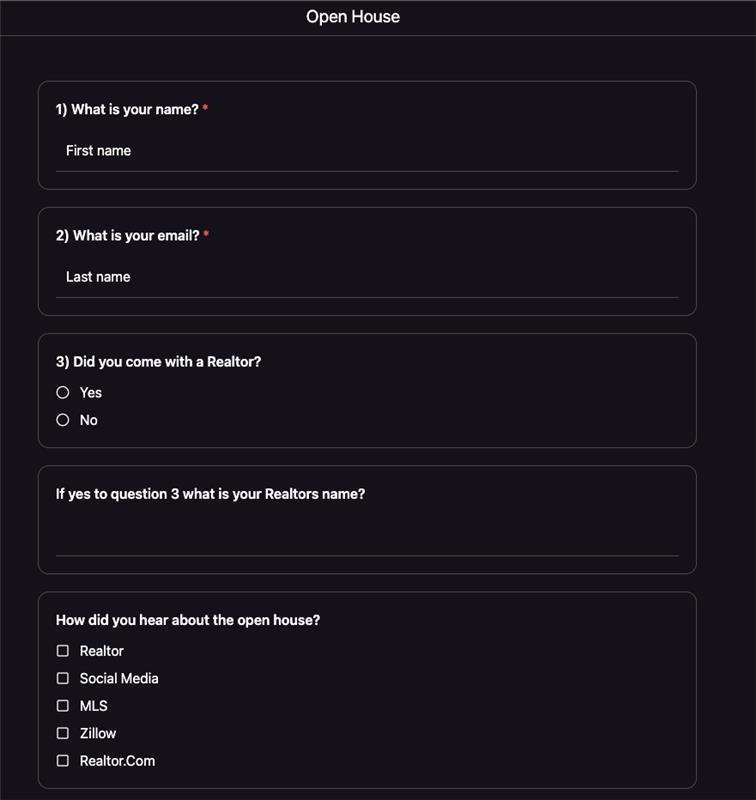

At Mloflo, we understand that one size doesn’t fit all, and that’s why we’ve introduced a customizable lead form featureto help loan officers capture exactly the information they need to close more deals.

With this new feature, you can create simple, efficient forms using either Google Forms or Typeform, and integrate them directly into your lead generation strategy. These forms can be tailored to ask the right questions and gather the most relevant data from your leads—saving you time and effort.

1. Tailor Your Lead Form to Your Needs

Not all loan applications are the same, so why should your lead forms be? Mloflo’s lead form feature allows you to customize the fields and questions based on your specific requirements. Whether you’re focusing on first-time homebuyers, refinancing, or another niche, you can collect the right details from the start.

This customization helps you:

-

Segment leads by type (e.g., pre-approved vs. first-time buyers)

-

Identify hot leads quickly by asking questions related to their urgency

-

Avoid collecting unnecessary data, keeping your process streamlined

For inspiration, check out lead generation form templates to help you design the perfect lead capture form for your business.

2. Automate Your Follow-Ups

One of the biggest challenges for loan officers is keeping up with follow-ups after initial contact. Lead forms help solve this problem by automating the process. Once your prospects fill out a form, they can be added directly to your CRM system, triggering personalized follow-up emails, SMS messages, or even phone calls.

This ensures that you never miss an opportunity and always stay engaged with potential clients.

3. Boost Your Conversion Rates

Using lead forms properly can significantly boost your conversion rates. By gathering key information upfront, you can qualify leads more effectively and ensure you’re focusing your efforts on those who are most likely to convert.

Plus, with Mloflo’s lead form feature, the integration with your CRM means you can easily track lead status and manage them more efficiently. With fewer steps between capturing leads and following up, you can close more deals in less time.

4. Make Your Lead Forms Mobile-Friendly

In today’s digital world, people expect convenience. With mobile-friendly lead forms, your prospects can quickly submit their information from anywhere, whether they’re at home or on the go. Mloflo ensures that your forms look great and function smoothly on all devices, allowing you to capture leads even when prospects are on their smartphones or tablets.

Final Thoughts

Lead forms are an essential tool in any loan officer’s toolkit. They simplify the process of gathering crucial information, enable faster follow-ups, and can ultimately help you close more deals. By leveraging Mloflo’s new lead form feature, you can streamline your process, increase your efficiency, and stay ahead of the competition.

Ready to start optimizing your deals? Check out Mloflo’s new lead form feature and see how it can help you close more loans with ease.

cts are on their smartphones or tablets.

Final Thoughts

Lead forms are an essential tool in any loan officer’s toolkit. They simplify the process of gathering crucial information, enable faster follow-ups, and can ultimately help you close more deals. By leveraging Mloflo’s new lead form feature, you can streamline your process, increase your efficiency, and stay ahead of the competition.

Ready to start optimizing your deals? Check out Mloflo’s new lead form feature and see how it can help you close more loans with ease.