Text Your Leads to Closing Day:

Why Every Loan Officer Needs a Mortgage CRM with SMS in 2024

Ditch cold calls & inbox purgatory! Text your way to mortgage marketing magic with an SMS-powered CRM.

Ditch cold calls & inbox purgatory! Text your way to mortgage marketing magic with an SMS-powered CRM.

Nurture relationships, build trust and closer deals faster using these best practices for SMS marketing.

Loan officers, picture this: You send a quick text with a pre-qualification link. You’re notify how many people leads moved forward. Within minutes, a lead can then become a hot prospect. So, by providing personalized updates, documents get uploaded promptly, saving a lot of stress for both you and the buyer. If you can be recognized as source for relevant, impactful information not only qill the result be a satisfied borrower closing on their dream home. But also a sources for continued business and referrals.

This is the tangible reality in 2024’s mortgage landscape, where speed, personalization, and cutting through the noise are king. And the secret weapon? A powerful mortgage CRM equipped with integrated SMS.

Now, hold on before you dismiss it as a “millennial thing.” Forget the age stereotypes. Everyone, from Gen Z juggling side hustles to Boomers craving tech-savvy solutions, expects fast, convenient communication.

And SMS delivers, big time. Here’s why ** ditching clunky spreadsheets for an SMS-powered CRM is your 2024 power move:**

Ignite Leads into Fireballs: Cold calls feel so 2004. With a single text, you spark immediate interest, trigger action, and keep your pipeline sizzling. Need income verification? Text a secure link. Pre-approval ready? Send a celebratory message and schedule signing. Boom, that’s conversion magic right there.

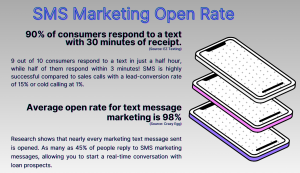

Escape the Email Black Hole: Emails get lost in the abyss. Texts get seen, opened, and acted upon.

Escape the Email Black Hole: Emails get lost in the abyss. Texts get seen, opened, and acted upon.

Send updates, schedule appointments, answer quick questions – all through SMS. Watch response rates skyrocket and feel the satisfaction of engaged, informed borrowers.

Personalization is Power: Don’t settle for robotic automation. Craft meaningful text messages tailored to each borrower’s journey.

Offer relevant content, celebrate milestones, show you care. It’s the human touch in a digital world, building trust and loyalty from the get-go.

Build Trust, Brick by Brick: Timely communication is more than just courtesy; it’s the foundation of trust. Keep your borrowers informed, proactive, and confident with regular SMS updates. They’ll feel valued and empowered, not just another loan file.

Workflow Supercharger: Tired of paperwork purgatory? Automate reminders, document requests, and follow-ups with your CRM. Free yourself from mundane tasks and focus on what matters most – building relationships and closing deals.

Ready to shed the outdated and embrace the future of mortgage marketing? MloFlo can seamlessly integrate your current marketing into a fully automated solution. This cutting-edge CRM with integrated SMS features is designed specifically by loan officers FOR LOAN OFFICERS.

See for yourself, schedule a free demo and witness how our total client mortgage marketing solution can transform your business.

The demand and the expectation for a CRM with SMS marketing capabilities will only continue to grow. Don’t get left behind in the 2024 , embrace the power of SMS and watch your business soar. Remember, this isn’t about trends; it’s about delivering exceptional service in the most current way.

#mortgagemarketing #loanofficers #mortgagebrokers

Ditch cold calls & inbox purgatory! Text your way to mortgage marketing magic with an SMS-powered CRM.

Ditch cold calls & inbox purgatory! Text your way to mortgage marketing magic with an SMS-powered CRM. Escape the Email Black Hole: Emails get lost in the abyss. Texts get seen, opened, and acted upon.

Escape the Email Black Hole: Emails get lost in the abyss. Texts get seen, opened, and acted upon.